.webp)

Shake things up! Supreme Court’s Adani panel wants sweeping reforms in Sebi’s functioning

Last week, the Securities and Exchange Board of India (Sebi) settled a case of an illegal advisory firm run by social media influencer PR Sundar and his family.

Sundar, his wife Mangayarkarasi and his firm Mansun Consultancy agreed to pay settlement fees of around INR15.6 lakh each in addition to disgorgement of INR6.07 crore.

The settlement order shows that the show-cause notice was issued to the three entities over a year ago and the probe started at least in April 2021, when the regulator got details of payments made to Sundar from Razorpay, a payments system provider.

The order has been hailed as a landmark driving home the fear of god in the minds of the emerging brood of financial influencers or finfluencers. But, the fact that two years of time and resources were deployed for what looks like a relatively minor case in terms of the amount involved and profile of the settlers, also highlights two key concerns raised by the Supreme Court-appointed expert committee — Sebi’s reluctant approach to settlement and need to focus on large and complex cases.

The committee headed by retired Supreme Court judge Abhay Manohar Sapre and comprising former SC judge JP Devdhar, ace bankers KV Kamath and OP Bhatt, IT veteran Nandan Nilekani and securities lawyer Somsekhar Sundaresan had submitted its report to the Supreme Court on May 6.

Last week, ET Prime had reported how the committee found that a key provision dropped by the regulator in 2019 set back its investigations.

A deeper reading of the 173-page report showed that though the report commended Sebi’s efforts and progress in areas such as surveillance and market administration, it has suggested several structural reforms, which if implemented, could change the face of Sebi as we know it.

These recommendations assume significance coming from a first-of-its-kind independent review of the functioning of the regulator by outsiders in recent years. Most reviews of Sebi regulations and discussion papers are either drafted by Sebi internally or by committees appointed by it with heavy representation of Sebi officials.

The panel said some of its recommendations could be similar to what have been recommended by the Financial Sector Legislative Reforms Commission (FSLRC), which had submitted its comprehensive report a decade ago.

However, in light of the Hindenburg Research’s report on Adani and the various submissions made by Sebi and stakeholders before the Sapre panel, a fresh look at some of these suggestions seem essential.

Focus on large cases and effective settlement

While the settlement order against Sundar is fresh in investors’ minds, there are not many examples of larger entities entering into settlement or for much larger amounts.

In fact, several large cases involving Reliance Industries and its group entities, the National Stock Exchange co-location issue, the NDTV-Vishvapradhan issue, and Gautam Thapar related matters have vacillated for years together in courts and appellate bodies.

Investigation is a complex matter. It requires a specific skill set and a mindset with healthy skepticism. Anything temporary is unlikely to give a permanent solution. Will a temporary committee have credibility? Will its outcome have a limited shelf life? Truth and justice cannot be temporarily administered

— Afsar Ebrahim, executive director, KICK Advisory Services

“The regulatory objective of Sebi may be better served by timely and sharp action in few large and complex cases as compared to frittering energy and resources in thousands of tiny cases. Every single case has a consequence but for a regulator to achieve its objective, it has to be strategic on how best it can prosecute cases of serious significance,” the Sapre panel said in its report.

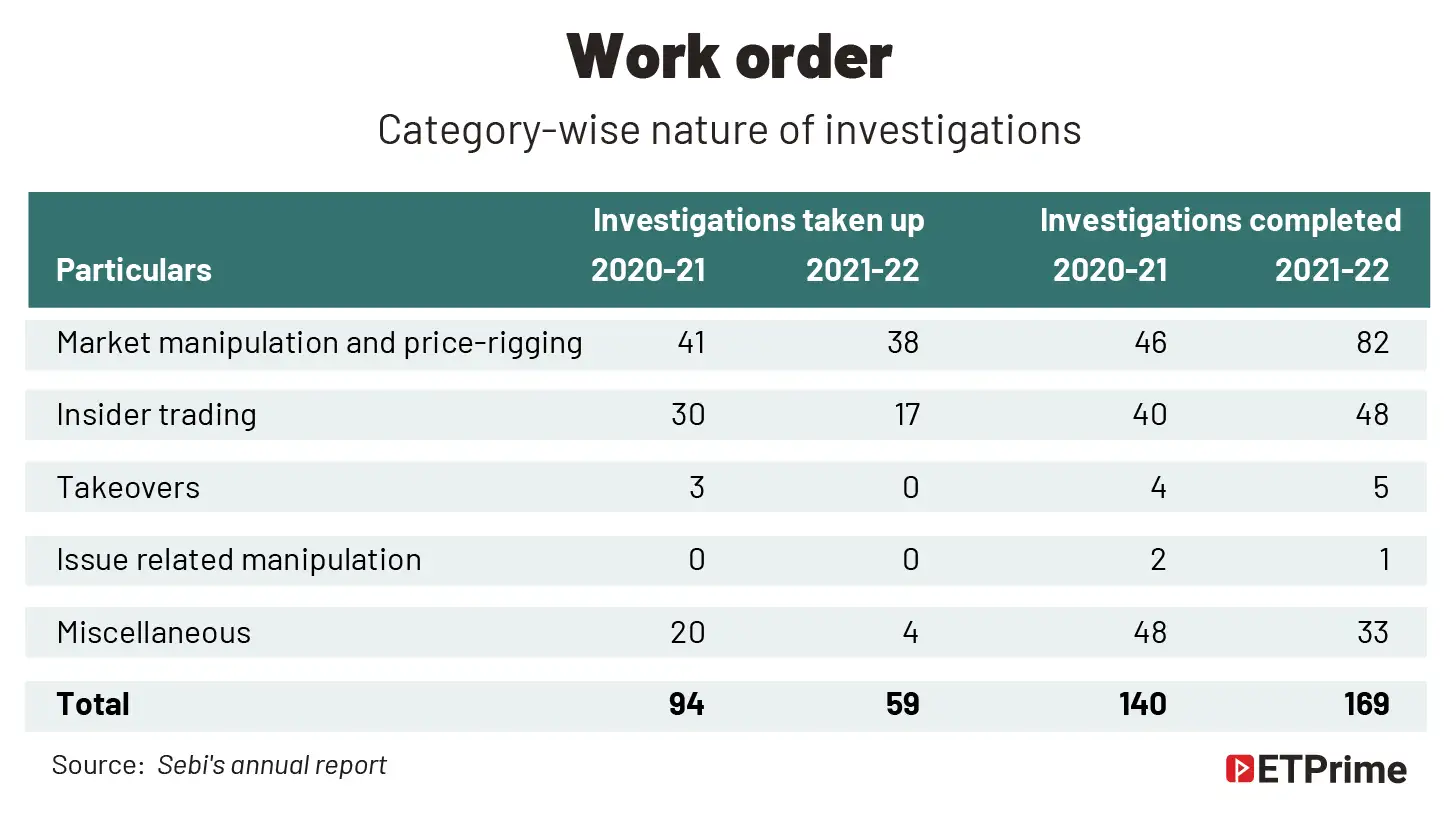

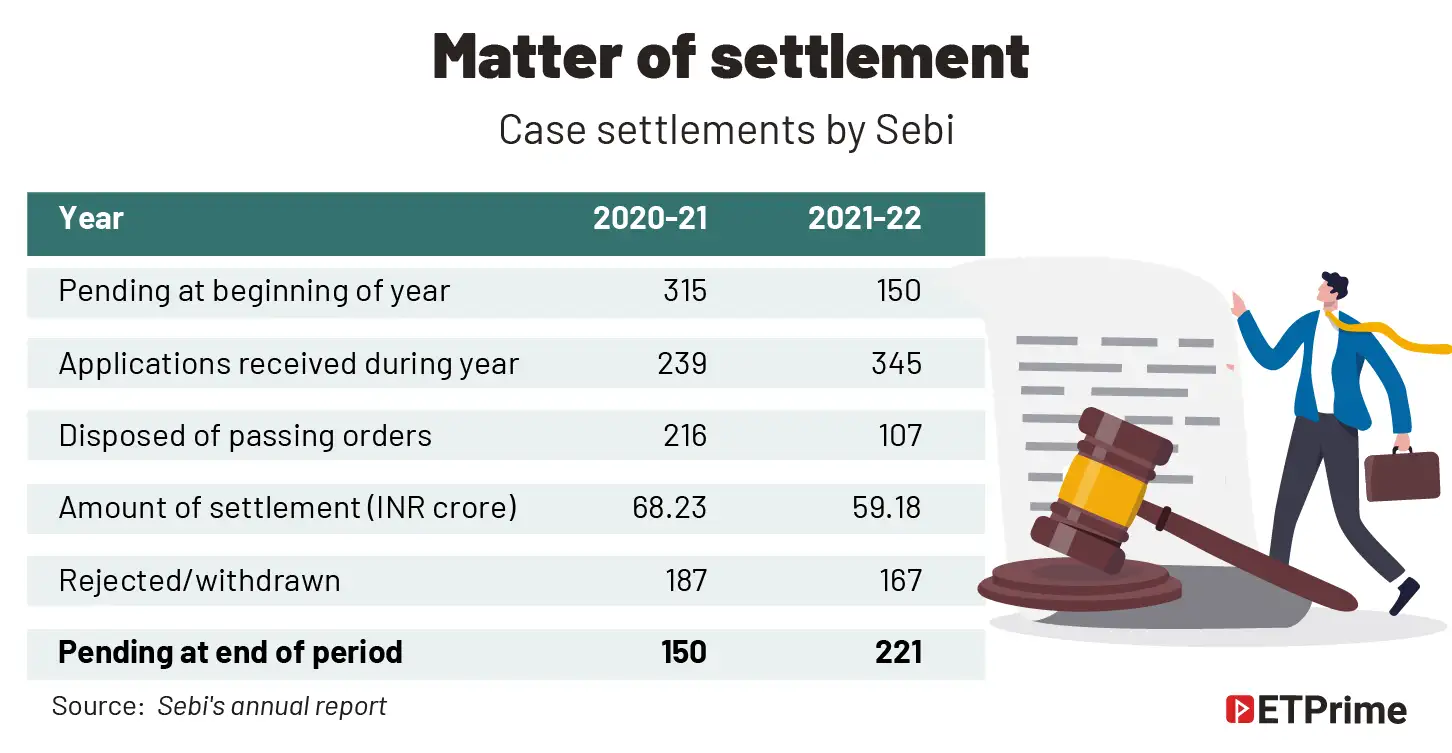

According to Sebi’s annual report, during 2021-22, Sebi received 345 applications for settlement. During the year, 107 applications were disposed of by passing appropriate settlement orders, while 167 applications were rejected or withdrawn.

The settlement application is first reviewed by an internal committee (IC). The recommendation of the IC is then reviewed by a High Powered Advisory Committee (HPAC) before being taken up by a panel of whole-time members of Sebi.

The Sapre panel had sought data on settlement proceedings and said “The information available at this stage does not lend itself to high-quality empirical analysis”.

The panel, however, identified some trends.

Data submitted by Sebi showed that between 2019-20 and 2021-22, Sebi has not differed with the HPAC in a single case. Pointing out to cases pending across several years, the panel recommended a time-bound disposal to be embedded in the settlement law itself.

The panel concluded, based on data, that the regulator’s approach to the settlement of proceedings is “still not robust”. It added that “there is an unstated perception of reluctance to settle potential proceedings arising from causes of action identified”.

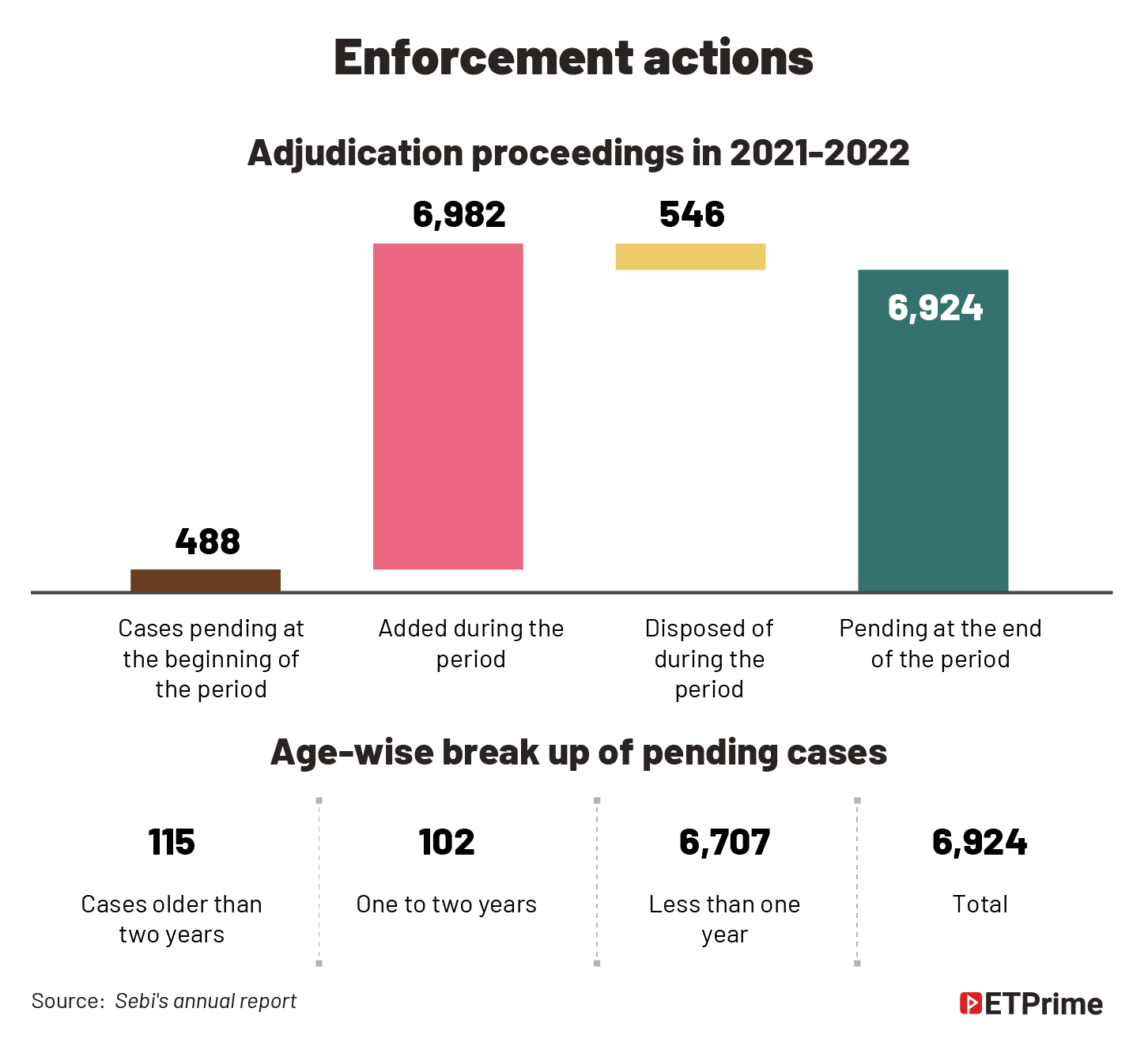

Pointing to an increasing number of enforcement actions, the panel said Sebi must put in place a coherent policy on settlement of proceedings, whereby financial injury, commensurate with the alleged violation may be inflected on the party.

At the same time, precious resources need not be expended. The panel observed that while the absolute number of settlements had gone up, the percentage had crashed to 4.79% from 42.5% the previous year.

This is largely due to a spike in overall enforcement cases.

In 2021-22, the regulator saw a 14-fold increase in enforcement cases to over 7,100 cases from 562 in the previous year.

Firm timelines and judicial discipline

The regulator has not had fixed timelines in completing investigations. For example, in some cases like the Vishvapradhan Commercial’s acquisition of shares of promoter entity of NDTV, Sebi’s orders came almost 11 years after the takeover event.

Explaining the approach of Sebi in the annual report of 2021-22, Madhabi Puri Buch, chairperson, Sebi had written, “In a market marked by diversity and complexity, we are conscious that a knee-jerk reaction to any event or mishap would not be in the best interest of the markets. Thus, a calibrated approach across diverse entities and a glide path approach over a period of time is the sustainable way to bring about change and reform in the market. Having said that, some issues merit a zero tolerance approach and where the integrity of the markets is at risk, such measures may also need to be adopted.”

Some market participants supported Sebi’s position saying investigation matters cannot be rushed. “Any regulator has added responsibility to ensure its investigation is in line with the rule of the law, must be factual and fair so that it survives any onslaught in a court of defence. Any decision can have huge repercussions therefore it should not rush to a hasty conclusion. The trade-off between timely conclusion and sharp action leading to rightness of the decision must be well balanced,” says Afsar Ebrahim, executive director, Kick Advisory Services, a Mauritius-based boutique advisory firm.

The Sapre panel has said the regulator must adopt a firm timeline for initiation and completion of investigations, initiation of proceedings, disposal of settlements and disposal of proceedings. “This must be embedded in the law. Needless to say, elements of such a timeline may be directory and other elements may be mandatory (as with any economic legislation). But a complete absence of timelines in the law is a stark feature that needs correction,” the panel said.

Similarly, the panel found that there is often no consistency in the manner in which different members of Sebi deal with the same issue or similar facts. “Judicial discipline is a must. Unless the rationale laid down by one adjudicating official has been upset or restated in appeal, it should be followed by others dealing in later cases. Likewise, once a ruling is set aside in appeal, unless the appellate order is stayed by the Supreme Court or the writ court, future adjudication by Sebi must abide by the law declared by the appellate order.”

Committee approach to investigation

Among the recommendations, which are now before the Supreme Court, is a move suggesting forming of temporary inter-agency committees to drive the timely completion of systemically important investigations. While the various financial sector regulators have a coordinating body — Financial Stability and Development Council or FSDC — the panel said a more focused committee with specific mandates can be looked at.

“In complex enforcement matters, where the skill-set and expertise of multiple regulatory and enforcement agencies would be necessary, it would be vital to have a framework by which a multi-agency committee (investigating committee) with a temporaryshelf life (just what is required for that particular case),” the Sapre panel has suggested.

Ebrahim of KICK Advisory Services has several questions about the idea. ”Investigation is a complex matter. It requires a specific skill set and a mindset with healthy skepticism. Anything temporary is unlikely to give a permanent solution. Will a temporary committee have credibility? Will its outcome have a limited shelf life? Truth and justice cannot be temporarily administered.”

The Sapre panel feels such a temporary committee can be placed under the FSDC and can be disbanded soon after its objectives are realised. “The framework being suggested must stipulate the criteria by which the case may be referred to such an investigating committee, by designating it as a systemically important investigation. The government must be able to resort to such a framework only when the case involved has serious cross-sectoral repercussions and would need multi-disciplinary skillsets to be brought to bear in a coordinated manner.”

For instance, the case of Infrastructure Leasing and Financial Services (IL&FS), which collapsed in 2018, and the Sahara group case which has spanned multiple regulatory turfs such as banking, securities markets and cooperatives are top of the mind examples that would fit such a suggestion.

Rebirth of unified regulator?

The Sapre panel also stressed on the separation of powers between the quasi-judicial arm and the executive arm of the regulator for it to be a true check and balance. “If performance of the quasi-judicial officers is appraised by the executive arm, the very foundation of powers would stand nullified,” the report said.

The panel also tried to give life to the long-buried proposal of a unified regulator, that was first put forth by the FSLRC, 10 years ago. The Sapre committee felt the creation of a unified financial redress agency that handles investor grievances across sectors could be a first step in this direction.

These sweeping reforms could fundamentally change the way the market regulator functions. While the suggestions seem well-meaning and founded on sound logic, it is for the Supreme Court to decide how to give shape to these.

(Graphics by Sadhana Saxena)

Resources - economictimes.indiatimes.com.