Did Jane Street manipulate Indian market or exploit its shallowness?

Douglas Schadewald and Rahul Yadav are two totally different-looking ends of the same thread.

Their backgrounds couldn’t have been more different. Their credentials couldn’t have been more in contrast. One is a Manhattan-based mathematical genius from Harvard who cut his teeth in big-bracket Wall Street firms. The other is a 10th-pass tax driver from Nalasopara, north of Mumbai, armed with just a tad more than tips from Youtubers and chats with passengers.

Yet, the strange world of the Indian derivatives market seems to have pitted them against one another. No prizes for guessing who walked laughing to the bank after this lopsided battle.

Worse, it has emerged from Securities and Exchange Board of India’s (Sebi) July 3 interim order against Schadewald’s former employer, quant trading giant Jane Street Group, that one of them might not even have played by the rules.

In an unprecedented order, the regulator barred the New York-based firm and its subsidiaries from the Indian securities market and also disgorged over INR4,800 crore illegal gains made by allegedly manipulating index options prices by dabbling in constituent stocks in the underlying cash market.

Despite elaborate surveillance mechanism, Sebi got drawn into Jane Street only after the later got into a legal battle with its star trader, Schadewald. In early 2024, Schadewald, who had shot to limelight by finding a place on Forbes 30 under 30 list in 2018 as the young head of Barclays’ options trading desk, jumped from Jane Street to rival fund Millenium Management with his understudy Daniel Spottiswood, a 26-year-old fresher.

But the high stakes involved (USD1 billion gains in Indian options market in a single year) not only made what would have been an innocuous Wall Street career move into a bitter court battle but also drew the eyes of Sebi to the trading strategies of Jane Street. Reason: Jane Street suspected that the duo had smuggled their trade secret that had earned it bumper profits in Indian options trading, and the fact that it was no longer able to make similar profits. Though Schadewald and Spottiswood denied the charges, they eventually got into a secret settlement. But by then, a Manhattan court argument revealing the billion-dollar single-year gain had rung the alarm bells thousands of miles away at the Sebi headquarters in Mumbai.

Questionable strategies

National Stock Exchange and Sebi examined the so-called ‘strategies’ of Jane Street and the trading patterns of group entities, particularly the derivatives contracts expiry days over the last two years. They then came to a conclusion that there was prima facie evidence of violation of fair practices regulations.

“At least on 21 days, the JS Group has prima facie engaged in illegal manipulation of the securities that comprise the Bank Nifty and Nifty indices, thereby vitiating market fairness and integrity, and illegally benefiting from their trading activities and positions in the index options markets,” Sebi whole-time member Ananth Narayan said in his ex parte interim order. “JS Group was undertaking an intentional, well-planned, and sinister scheme and artifice to manipulate cash and futures markets and hence manipulate the Bank Nifty index level, to entice small investors to trade at unfavourable and misleading prices, and to the advantage of the JS Group.

The detailed analysis of the trades revealed the existence of a strategy (“Intraday Index Manipulation” strategy), which appears to have been similarly deployed by the JS Group in 15 days out of 18 days covered in the Sebi order. A different strategy (“Extended Marking the Close” strategy) was observed on the other three days. The latter strategy was also seen to have been deployed on three other days post the examination period in Nifty index options in May 2025.

On January 17, 2024, JS Group traded in an “Intra Day Index Manipulation pattern”. Dealing in multiple segments across cash equities, stock futures, index futures, and index options simultaneously is certainly not by itself a breach of any regulation. However, what sets apart the trading pattern of the JS Group as described above as prima facie being manipulative, is the intensity and sheer scale of their intervention in the underlying component stock and futures markets, the rapid reversal of these large and aggressive trading in cash and futures without any plausible economic rationale, other than the concurrent activity in and impact on their positions in the Bank Nifty index options markets.

Pump & dump

“I think this is a classic pump and dump scheme, which normally happens in small caps where brokers manipulate prices and then dump those stocks on retail investors. But in the case of Jane Street, they did the same thing with large-cap stocks because they simply had the technology and the money to do this in the large-cap space”, says Anish Teli, managing partner, QED Capital Advisors. He says Jane Street is a big firm and its operations in the Indian markets are small.

In 2024, Jane Street had made USD20.5 billion in net trading revenue – up 100% over the previous year. India accounted for 10% or USD2 billion of this. This total profits for Jane Street were much higher than Citigroup (USD19.8 billion) and Bank of America (USD18.8 billion) making it the top trading firm across the world. Its largest market is the US at 10% and 18 more countries that account for 8% of the total volumes of the clearing corporation in 2024. Profits made in India are a staggering USD4.5 billion (INR36,500 crore) between January 2023 and March 2025.

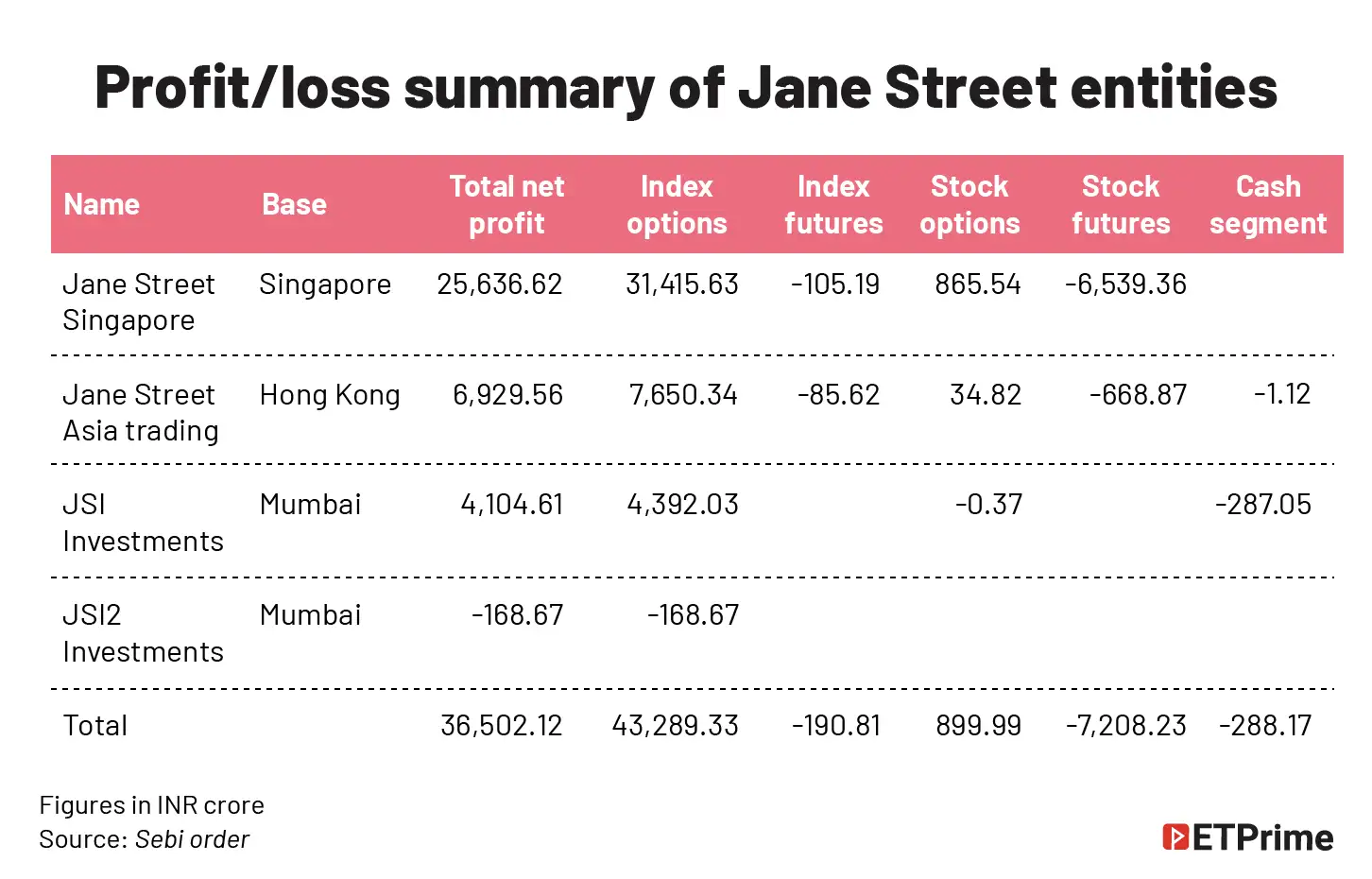

Out of the four entities involved in the current case, two entities – Jane Street Singapore Pte Ltd and Jane Street Asia Trading Ltd are registered FPIs incorporated in Singapore and Hong Kong, respectively. JSI Investments Private Limited – was incorporated in India in December 2020 and JSI2 Investments Private Limited in September 2024. Both are located in Mumbai. From e-mail and other interactions, Sebi has concluded that all Jane Street Group entities dealing in the Indian markets act collectively.

An analysis of the segment-wise profit and loss showed that Jane Street’s Singapore arm was the most profitable with net gains of INR25,636 crore followed by the Hong Kong-based FPI. While index options were the most profitable contract for Jane Street, followed by Stock options, the group lost money in stock futures (INR7,208.23 crore), index futures (INR190 crore) and cash segment (INR288.17 crore).

“This is not a surprise. Veteran traders know this happens. These are big guys who have been rampant and flagrant. Finally, something is being done about it,” says a senior prop trader.

Threat to derivatives crown?

Sophisticated high-frequency traders like Schadewald and retail traders like Yadav are two sides of the same coin. Both have grown side by side, making India the largest derivative markets in the world. Proprietary high-frequency traders like Jane Street and a select group of institutional players using algorithms have also driven the Indian derivatives markets.

As per data from Statista, NSE cemented its place as the largest derivatives exchange in the world in 2023. It traded nearly 85 billion derivatives contracts in 2023, followed by the Brazilian exchange, B3, with 8.3 billion contracts.

Will the Sebi order on Jane Street destabilize the Indian derivatives market?

FPIs and proprietary traders mainly trade through algorithms (commonly known as algorithmic trading). In fact, 306 of the 376 FPIs trade through algorithms, while 347 out of 626 proprietary traders tradethrough algorithms. On theother hand, only 13% of 9.57 million individual traders trade through algorithms.

“Prop trading firms like Jane Street account for nearly 50% of options trading volumes. If they pull back — which seems likely — retail activity (35%) could take a hit too. So, this could be bad news for both exchanges and brokers. The next few days will be telling. F&O volumes might reveal just how reliant we are on these prop giants,” Zerodha founder Nitin Kamath posted on social media.

While some quarters, who have played their part in democratising the market with ease of access through mobile applications and YouTube tutorials on trading strategies, fear loss of volumes, there doesn’t seem any real threat to NSE losing the derivatives crown, as that would take a 90% fall in contract volumes.

Futility of options

Experienced traders say options trading is a zero-sum game, meaning if Jane Street made these gains, there are counterparties who made losses of equal amounts. This is where retail traders like Yadav come in.

Coincidentally, Yadav’s story got posted on the very day Sebi published its order. Speaking to a TV reporter even as he waded through the Mumbai traffic, Yadav narrated how he lost INR2.5 lakh in 2024 alone in his desperation to “bahut jaldhi aage badne ka (get rich quickly).”

It was savings of two-three years of the 30-year-old, who earned INR20,000-INR25,000 a month from his rides, he told the reporter.

Inexperienced, under-informed first-time traders like Yadav, influenced by finfluencers on social media platforms, have flocked the Indian markets pushing up option trading volumes manifold in the past few years.

The availability of sophisticated trading platforms and lower transaction costs have enabled retail investors to actively trade in Options and Futures (F&O) contracts, contributing to the surge in market liquidity. The number of retail traders have almost doubled in two years from about 5.1 million in FY22 to about 9.6 million in FY24.

Although they contributed about 30% in total turnover in FY24, they are a clear majority in terms of numbers -- 99.8% of total traders in the equity F&O segment are Individuals. “Almost halfof all the F&O traders in FY24 (4.2 million traders) were “new traders” (traders who traded for the first time in three years in the equity F&O segment). And 92.1% of these “new traders” experienced losses and on an average booked a net loss of about INR46,000 per person in FY24,” the Sebi report found.

Many of the retail traders are unsophisticated who go by misleading recommendations on social media by those who pretend to be experts.

“Retail here is going heavily into selling options. YouTube guys keep telling them to sell this option, that option and give strategies that sound intelligent, but are unsound. After listening to these videos, they (retail traders) get this bias that they have learnt something very technical and good. So, they feel it must be very secure. If not Jane Street, somebody else would have bet against them,” says Pune-based chartist Deepak Mohoni. “Option writing is not a great strategy.’’

Referring to Nassim Nichola Taleb’s quote, in his book Fooled by Randomness, which goes ‘option sellers eat like chicken, but go to bathroom like elephants,’ Mohoni emphasises that the huge leverage means even a single bad call can potentially “wipe out not only trader’s trading capital, but could be bad enough to take away the house he lives in.”

Options are well designed for institutions. They can use many strategies to make money month after month. And retail investors, most of the time write options. Anybody would bet against them as they lose 90% of the time, Mohoni adds.

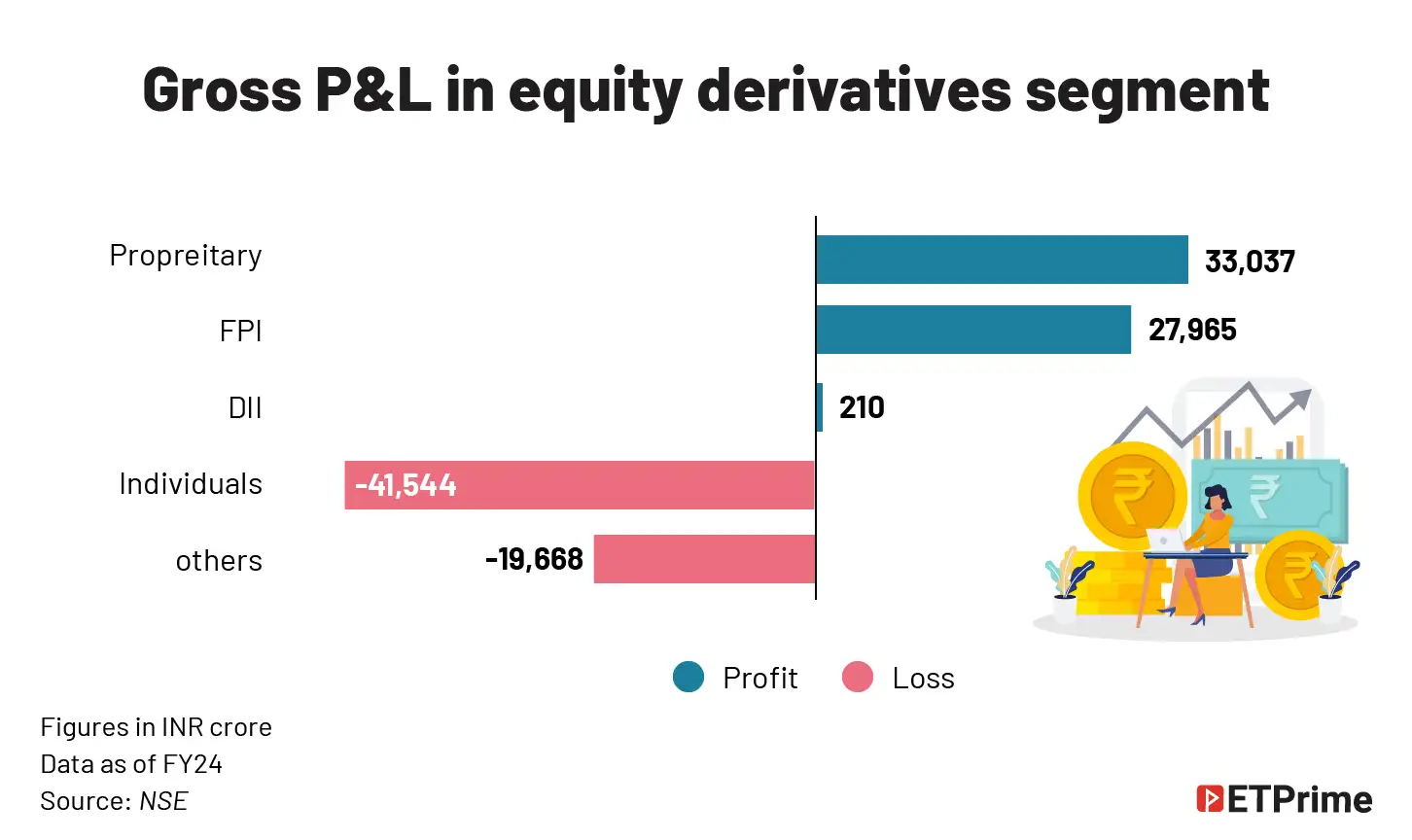

There’s overwhelming evidence of this in the Sebi report. At an aggregate level, INR61,000 crore of profit was made in FY24 in the equity derivatives segment. Prop traders (INR33,000 crore) and FPIs (INR27,000) almost split these gains, while retail traders were the suckers accounting for a lion’s share of the losses (INR41,600 crore).

Options were a complete disaster for individuals as they clocked losses of INR 55000 crore only to be partially offset by gains of INR13,400 crore in the futures segment. This kind of market structure lends itself to larger players taking advantage of the retail traders, say market participants.

In addition to this, there are problems with the product structure.

Vulnerability of Bank Nifty

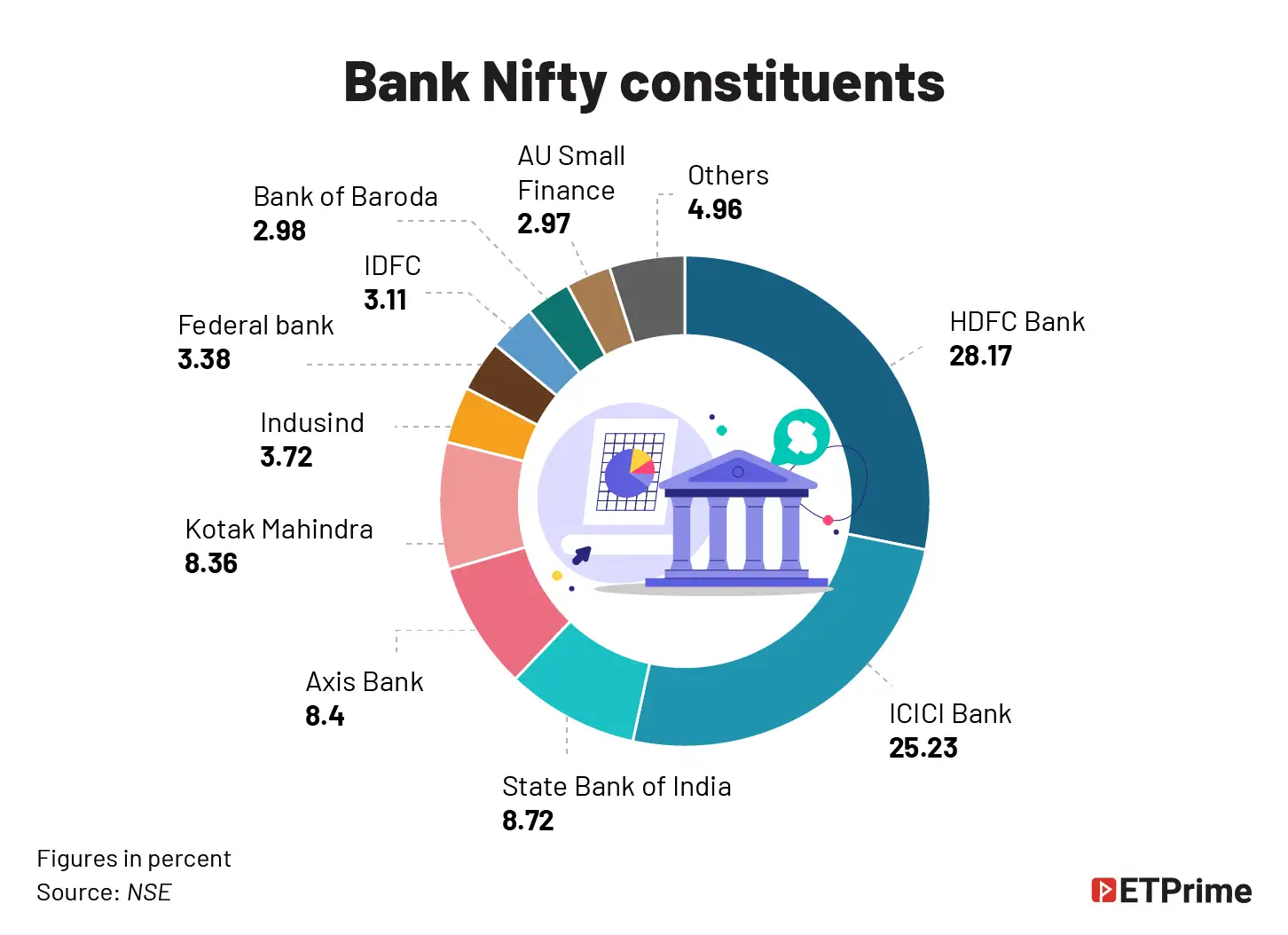

About 40% of Jane Street gains came in Bank Nifty. The manipulation was in the Bank Nifty index, which consists of around 12 stocks only. So, it’s nothing to do with the whole market. Just two stocks in the Bank Nifty —HDFC and ICICI Bank — account for over 50% of its weight, so it’s easy to manipulate this index.

Two, if you read the Sebi order, the trades placed by Jane Street amounted to around 25% of the traded volume in the index components.

Three, if they concentrated their buying or selling in 1-2 hours, as they did, they would probably account for 60%-70% of the trades at the relevant time and into the close of the market.

“The problem is not Jane Street. The problem is the structure of the market and the regulators,” says a senior broker. Ajay Pandey, who runs a portfolio-management services firm in Mumbai, questions the role of the exchange and regulators in allowing such huge limits to a single player. “When smaller players trade, we are told of broker-wise limits, client-wise limits and the need to acquire such limits beforehand. But how did they allow such unlimited limits to the extent the entire market is manipulated?”

Another senior proprietary trader says the index itself is so structured that the stronger performers among the constituents keep gaining in weight while the weaker ones fall off the grid. “This creates a cycle where the concentration of index weight in a few stocks only increases over time. This makes the index look artificially better and it doesn’t reflect the actual state of the market,” he argues.

Santosh Pasi, a derivatives trader says, “To further enhance market integrity, regulators could introduce volume-based trading limits for individual clients, similar to the OI (open interest) limits already in place.” According to Pasi, this would prevent any single client from dominating the market or influencing prices through excessive trading. For example, a client could be restricted from trading more than a certain percentage (5%-10%) of the total volume in the cash market. Indian markets do not allow short selling. If there were short sellers in the cash market, this could have acted as a deterrent, feel some market participants.

A cat-and-mouse game

Market participants are impressed by Sebi’s strong measures. On the other hand, many of them appreciate that the interim order may be a job well begun, but it is only a job half done for Sebi. It has a tough task defending the matter in appellate tribunal even as it tries to take the probe to a logical conclusion.

“Credit must go to Sebi for concluding that a complex trading strategy is being construed as market manipulation. Sebi has earned brownie points for being a sophisticated regulator. I don't know many regulators globally who would have identified this in such a manner; a true surgical strike,” says Afsar Ebrahim, founder of Mauritius-based Kick Advisory Services, which consults for FPIs.

Kamath of Zerodha drew a comparison to the weak regulatory regime in the US. “You’ve got to hand it to Sebi for going after Jane Street. If the allegations are true, it’s blatant market manipulation. The shocking part? They kept at it even after receiving warnings from the exchanges. Maybe this is what happens when you're used to the lenient US regulatory regime. Think about the structure of the US markets: dark pools, payment for order flow, and other loopholes that allow hedge funds to make billions off retail investors. None of these practices would be allowed in India, thanks to our regulators.”

A note by Dolat Capital lauded some of the measures taken by Sebi even as the Jane Street probe was on. “Believe above activity saw Sebi initiating various measures (one weekly expiry per exchange, introduction of Fut equivalent OI) on option segment much prior to the above order – a positive step,” the note said.

Mohoni, however, says, “It would be a tough case for Sebi to crack. Where does the strategy end and where does the manipulation begin?” Any large institution buying or selling, they are going to move the markets. They analysed the patterns of trades and attacked the profit opportunities. Though algorithms might be executing the trades, in the end, there is always a human. The query that tells them to do this may not be malicious. So, how do you then establish manipulation?

“It comes to intent. Were they manipulating or were they just playing the market?” Mohoni asks. Jane Street has strongly denied any wrongdoing and has vowed to prove innocence. Incurring losses in cash and futures markets in a deliberate and systematic manner itself is unusual. This is an unusual case where prima facie multiple liquid stocks with high retail participation have together been manipulated to facilitate the manipulation of the index options market, resulting in massive profits for the manipulators, at the cost of other participants and retail traders, say market participants.

Further, Jane Street had used two local entities to execute manipulative trades in the cash market, thereby circumventing FPI regulations.

“To prevent regulatory arbitrage, any local company in India associated with a foreign portfolio investor (FPI) should be subject to the same trading rules and regulations as the FPI. This means that the local company should be treated as a subsidiary or affiliate of the FPI, and all FPI trading regulations should apply to it,” says Pasi.

“What India needs to do is make regulations easy and attract more firms like Jane Street so that no single firm will have the guts to take large positions in the cash and derivatives market as they will feel threatened that there will be someone who will have a position that will be different from theirs. Derivatives are complex products and traders often lose but regulators should deepen the market than make it safe for retail traders”, an algo trader argues.

Prescriptions might flood in and vary in tone and texture, but the harsh reality is securities market regulations are often a cat-and-mouse game. For every new regulation and circular, there are smart alecs working hard to figure out loopholes and inefficiencies to make a quick buck. This is where continuous and efficient surveillance and quick response from the exchanges and regulators become important. While Sebi has earned brownie points for taking cues from media reports from Manhattan, it makes one ponder what if Douglas Schadewald had not decided to move from Jane Street to Millenium last spring.

Resources : economictimes.indiatimes.com