Africa –Bonfire of Opportunities

Abstract

Africa’s emergence as a one of the destinations to invest is none less than being invited to the biggest BONFIRE party. Here is an article that is highlights some key aspects for Indian businesses.

If any word that come close to describing what Africa truly is from an untapped potential, its “Bonfire”. Africa’s emergence as one destination for investments is non less that of a Bonfire of opportunities besides that it is not one country but a continent with 54 countries; 54 markets; 54 cultures; 54 Legal Framework; 54 Fiscal Regimes.

If you are a firm that truly value geographical diversification of your revenue then you should shift focus from taking advantage of a transaction but to prepare a strategy up front which makes evaluation of opportunities in a more structured manner. Having a well-prepared African strategy will help you getting ready to blend into the Africa’s rich business and cultural diversity that would help you qualify the first round.

I recently had an opportunity to speak on a webinar hosted by Mrs. Sunanda Rajendran, the secretary-general of the Indo-African Chamber of Commerce and Industry to address 100plus Indian firms on Africa Strategy, on 15th Oct 2020.

Meticulous planning and right content of the webinar by Mrs. Sunanda was what made it to its success. I am glad that I got this opportunity, and I can share my learnings on “Africa entry strategy” with all of you.

So, to write a successful business strategy to access Africa, let me answer Why Indian companies must consider Africa in the first place?

Africa offers a higher return on investment than any other emerging market

Frankly, Africa will test your patience. If you are a big corporate in India doesn’t necessary will make you a winner in Africa’s time horizons and return models that fit India don’t always work in there. Even the most experienced, sophisticated companies can be forced to recalibrate. India is not Africa, India is 1 country, Africa is 54 countries.

With right local partners and local knowledge and skilled advisory from professionals who know the terrain, the probability of greater prosperity for investors in Africa will be realized.

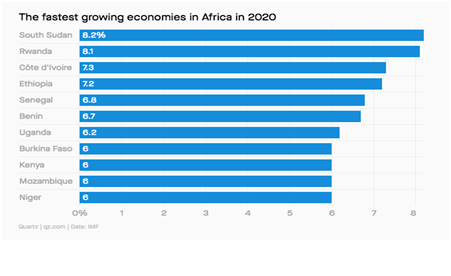

Whats worthy of noting is Africa had some of world’s fastest-growing economies in 2019 and 2020 is no different.

Source :- Quartz| Data :- IMF

The top performers are South Sudan (8.2%), Rwanda (8.1%) Côte d’Ivoire (7.3%), Ethiopia (7.2%), Senegal (6.8%), Benin (6.7%) and Uganda (6.2%) along with Kenya, Mozambique, Niger and Burkina Faso all expecting 6% growth.

Increasing demand: Similar to India, Africa is poised to gain from its middle class population and demographic dividend. We have witnessed steady rise business in Telecommunication, Technology and banking - African consumers have different needs over internet and mobile. Large markets like Nigeria, South Africa and Ethiopia have increased interest due to digitization and access to distribution channels are being disrupted, FMCG that’s meeting the needs of a growing middle class population will succeed because competitive advantages in India may not easily be replicated as comparative advantages.

Doing business with Africa is becoming easier: Governments have reduced trade barriers, cut corporate taxes, and strengthened regulatory and legal systems.

Africa is diversifying

Though in the early stages African economies are finally beginning to diversify beyond commodities. They are beginning to place bets on non-commodity areas where they can be competitive leveraging on their talent pool and efforts are underway to package themselves so as to appeal to a broader set of investors.

Africa can lead in sustainable development

Africa is more ready today and is resilient. Its embracing new technology and ideas. Its readiness to develop flexible fuel grids that generate power with a mix of abundant wind, solar, hydro and bio energy, alongside conventional fuels such as oil and gas, which are also abundant. The spectrum of opportunity has only broaden.

For entrepreneurs and businesses with ideas and an appetite for risk can bring value and find long-term growth if they are persistent, creative, and determined.

Challenges and counters

After all Africa is 54 countries with diversity in policies, governments, taxes, cultures etc hence selection of a country for investment is necessary to understand. Some of the evaluations must be carried right at the inception stage while penning a strategy to enter Africa are :

- Country targeting is essential:

- Connectivity for Trade

- Country risk

- Ease of doing business

- Cost of doing business

- Size of the market/ market growth/potential export markets

- Existing competition

- Researching the Market for the Product

- In-depth understanding of distribution channel

- Laws and regulations

- Marketing and channel of sales management

Way forward and How Kick Advisory can help

The success stories between India and Africa have been few and far between. There is a need for opportunistic investments but supported with a clear strategy, and one needs to go into African markets in partnership with local markets and investors.

Investment needs to be long-term for the existing businesses. Third gen syndrome, strategic alliances are important. Technical interest in manufacturing sector is in demand and use of intermediaries, law firms, accounting firms and bankers has increased.

For Geographical diversification to succeed, local context needs to be kept in mind. Therefore, a local partner, a local hero is needed for support.

Business culture is similar like India, people buy from people. It is very relationship driven.

I personally have supported several business forays into this amazing continent and have hand held them in their journey of setting and expanding in Africa. With Kick Advisory services.

About the Author

Afsar ebrahim, FCA CF- Executive Director, Kick Advisory Services,

Afsar worked as a Deputy Group Managing Partner at BDO with focus on Corporate Finance of BDO in Mauritius, Kenya, Tanzania, Uganda, Madagascar and Seychelles, the largest professional services firm in Sub Saharan Africa. He has significant advisory experience in several areas of Telecommunications, Banking, Sugar, Hotels and Textiles, Insurance and Financial Services. From 1997 to 2003 he was Manager Corporate & Investment Banking with HSBC Mauritius. He is a Fellow of the Institute of Chartered Accountants in England and Wales, prize winner in professional exam (PE 1), with over 25years of professional experience in Setting Up new businesses, Corporate Restructuring, Litigation Support, Mergers & Acquisitions and Raising of funds, Auditing and Financial Consulting locally and internationally. He was granted the Corporate Finance qualification from ICAEW in December 2006.

Afsar worked as a Deputy Group Managing Partner at BDO with focus on Corporate Finance of BDO in Mauritius, Kenya, Tanzania, Uganda, Madagascar and Seychelles, the largest professional services firm in Sub Saharan Africa. He has significant advisory experience in several areas of Telecommunications, Banking, Sugar, Hotels and Textiles, Insurance and Financial Services. From 1997 to 2003 he was Manager Corporate & Investment Banking with HSBC Mauritius. He is a Fellow of the Institute of Chartered Accountants in England and Wales, prize winner in professional exam (PE 1), with over 25years of professional experience in Setting Up new businesses, Corporate Restructuring, Litigation Support, Mergers & Acquisitions and Raising of funds, Auditing and Financial Consulting locally and internationally. He was granted the Corporate Finance qualification from ICAEW in December 2006.

Membership in Professional Societies:

-

- Member of the Institute of Chartered Accountants in England & Wales (ICAEW) in January 1991

- Fellowship awarded in May 2001

- Corporate Finance qualification from ICAEW in December 2006.

- Arbitrator at the Permanent Court of Arbitration of the Mauritius Chamber of Commerce and Industry

- Founding Member of Mauritius Africa Business Club